.jpg)

FEATURED ARTICLE

Expanding Horizons: Essential Insights for Brands Entering Southeast Asia in 2023

Baozun Asia

Sep 04· 8 Min read

.jpg)

Expanding Horizons: Essential Insights for Brands Entering Southeast Asia in 2023

Baozun Asia

Sep 04· 8 Min read

Southeast Asia stands as a beacon for digital innovation and growth, drawing attention with its intricate blend of cultures and booming economies. The fervour for technological advancement, combined with its demographic potential, has painted the region as a hotspot for brands hungry for expansion.

Notably, global powerhouses from China, the US, and the EU are making strategic inroads into this lucrative market. Attracted by the region's youthful, digital-first populace and the meteoric rise of local eCommerce platforms, these titans are meticulously tailoring their approaches to strike a chord with the Southeast Asian audience. As such, the stage is set for a dynamic confluence of regional tastes and international brand prowess.

Read More...Southeast Asia stands as a beacon for digital innovation and growth, drawing attention with its intricate blend of cultures and booming economies. The fervour for technological advancement, combined with its demographic potential, has painted the region as a hotspot for brands hungry for expansion.

Notably, global powerhouses from China, the US, and the EU are making strategic inroads into this lucrative market. Attracted by the region's youthful, digital-first populace and the meteoric rise of local eCommerce platforms, these titans are meticulously tailoring their approaches to strike a chord with the Southeast Asian audience. As such, the stage is set for a dynamic confluence of regional tastes and international brand prowess.

Southeast Asia (SEA) has increasingly emerged as a hotspot for eCommerce. But what makes this region so appealing, particularly for brands considering a foray into these markets?

1. A Sprawling and Young Population Base

Southeast Asia is home to over 680 million individuals. To understand the sheer magnitude of this, imagine combining the populations of several European giants like France, Germany, the UK, and Italy and then doubling that number.

This offers a vast market potential for brands aiming to expand their reach. Moreover, with over 50% of this population being under the age of 30, brands have the opportunity to tap into a youthful demographic that is more open to digital shopping experiences with adaptable spending habits.

2. A Blossoming Middle Class With Spending Power

The region is witnessing a substantial rise in its middle class, with numbers reaching up to 400 million individuals. As the middle class grows, purchasing behaviours change. Consumers in this bracket often look for aspirational products, demonstrating a trend toward valuing quality over quantity.

Moreover, as disposable incomes rise, there's a distinct trend towards heightened brand loyalty and preference, paving the way for international and luxury brands to fortify their foothold. By 2024, over half of Asians will fall under either the "middle class" or "rich" categories.

Specifically, they will be spending between $12 and $120 per day, adjusted for purchasing power parity (PPP), or even more than $120 per day.

3. Pioneering a Mobile-first Digital Evolution

The digital landscape of SEA is predominantly mobile-driven. Mobile phone penetration rates in many countries here exceed 90%, with a notable chunk of the population owning multiple devices. This gives brands a direct line to engage with their customers.

Adding to this, a significant percentage of online transactions are made via mobile platforms, underscoring the importance of mobile optimisation for seamless user experiences.

4. Untapped Potential in the eCommerce Space

Despite the evident readiness of the SEA's population, eCommerce currently accounts for only 3.2% of the region's total retail sales. This discrepancy suggests a massive untapped potential.

Brands stepping into the Southeast Asian eCommerce market now can position themselves as pioneers and influence consumer behaviour, considering projections indicate that regional eCommerce activities could skyrocket to a value of $300 billion by 2025.

5. The Emergence and Dominance of Social Commerce

Traditional eCommerce platforms are just one part of the SEA online shopping equation. An estimated 50% of eCommerce GMV (Gross Merchandise Value) in the region comes from transactions conducted on social media platforms.

With Southeast Asians being among the most engaged mobile internet users in the world, averaging 3.6 hours per day, brands have an unparalleled opportunity to leverage social commerce to interact with consumers where they are most active and forge deeper connections.

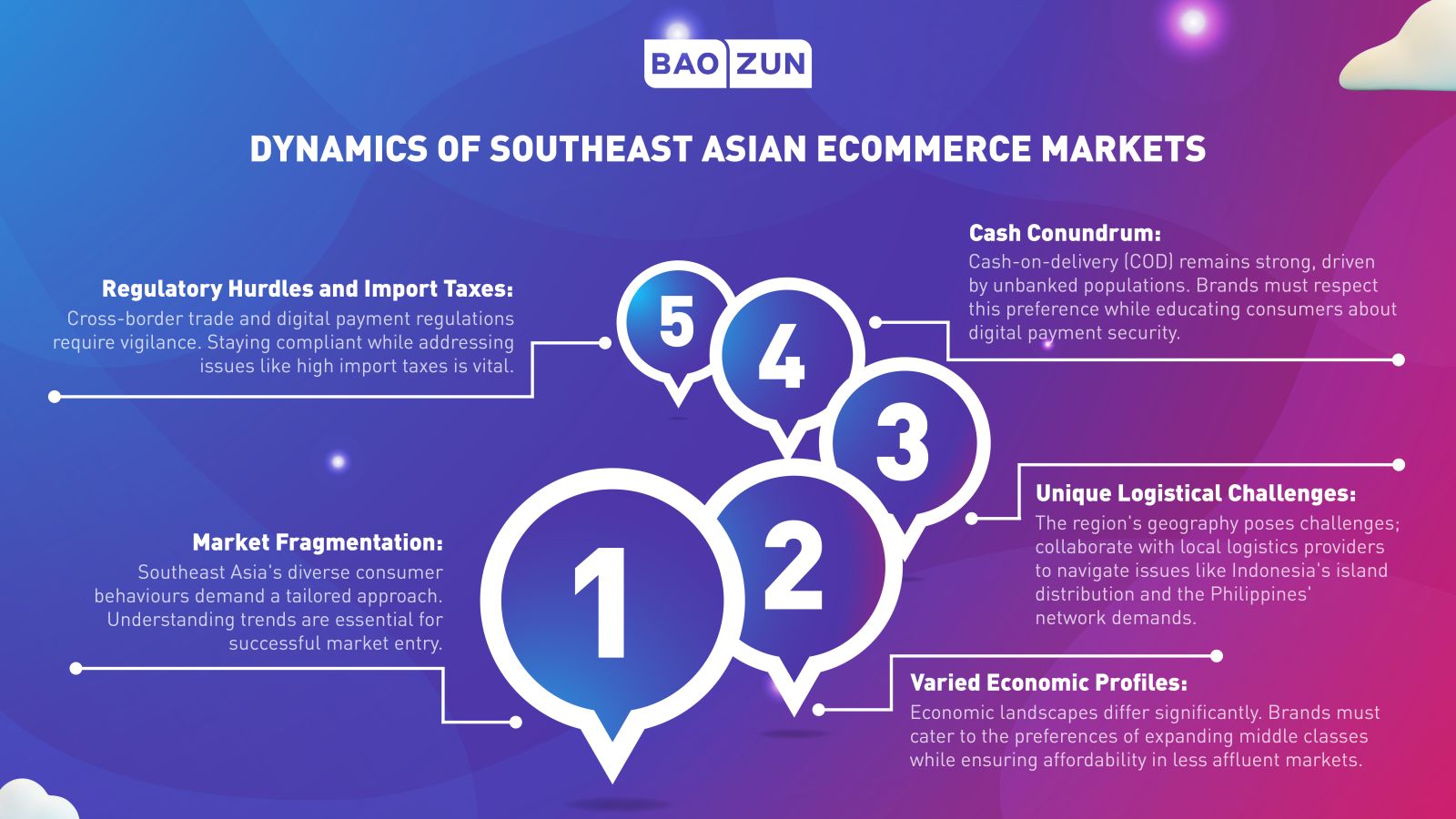

Southeast Asia is not a monolithic market. The region comprises ten diverse countries with unique cultural, economic, and digital landscapes. For brands considering entering the arena, understanding these intricate dynamics is crucial.

SEA is characterised by its diverse tapestry of languages, cultures, and consumer preferences.

|

Country |

Cultural Influences |

Consumer Behavior & Insights |

|

Singapore |

Chinese, Malay, Indian |

Tech-savvy, high purchasing power, open to international trends |

|

Malaysia |

Malay, Chinese, Indian, Islam |

Shopping spikes during Ramadan for Hari Raya celebrations |

|

Philippines |

Spanish, American |

Value family-oriented campaigns, strong affinity for entertainment |

|

Vietnam |

Traditional Vietnamese |

Price-conscious, value quality, influenced by local celebrities |

|

Thailand |

Unique, Buddhist |

Digital enthusiasts, merge traditional elements with modernity |

|

Indonesia |

Diverse ethnic, Muslim |

Trend towards halal products, importance of religious events like Ramadan |

For instance, what's trending in Singapore may not resonate with consumers in Laos. Internet penetration, too, varies drastically - a high of 92% in Singapore contrasts sharply with 44% in Myanmar.

Consequently, a one-size-fits-all approach is not viable. Brands must adopt a market-by-market strategy, which requires investing in localised content, customer service, and product offerings.

The region houses economically prosperous countries, like Singapore, and emerging economies like Myanmar. Purchasing power, infrastructure, and even payment methods differ significantly.

There's a discernible shift towards premium products in nations where the middle class is expanding rapidly (e.g., Indonesia and Vietnam). Conversely, affordability remains a top priority for consumers in less affluent areas.

3. Unique Logistical Challenges

SEA's geographical makeup poses particular logistical issues. With Indonesia spanning over 6,000 inhabited islands and 45% of its population residing in rural locales, last-mile delivery becomes complex.

Elsewhere, in the Philippines, efficient distribution networks are vital. Brands need to collaborate with local logistics providers or invest in robust distribution systems to ensure timely and accurate deliveries.

4. The Cash Conundrum

While digital payments are gaining traction, cash-on-delivery (COD) remains the dominant payment method across many SEA countries. In previous years, COD made up 47% of payment methods used for digital purchases in the Philippines, 42.8% in Vietnam, and 20.6% in Indonesia. This is primarily because a significant portion of the populace remains unbanked or underbanked.

The accessibility and familiarity of COD align with the financial realities of these regions, enabling a more inclusive approach to online transactions. Brands and retailers venturing into these markets must be attuned to these local nuances, ensuring a seamless online shopping experience while concurrently educating consumers about the advantages and security of digital payment methods.

5. Regulatory Hurdles and Import Taxes

Navigating the regulatory environment in the region can be intricate. Regulations around eCommerce, cross-border trade, and digital payments are still evolving in many countries.

For instance, high import taxes can hamper cross-border eCommerce. Brands need to stay abreast of these changing regulations and devise strategies that are compliant while still being competitive.

While digital platforms offer swift market penetration, they come with their own set of complexities. Brands must tailor their strategies - from marketing to product offerings - to resonate with each nation's unique preferences and cultural tapestries within the region.

1. Gojek

Originating as a mere ride-hailing app, Gojek's transformative journey into a multi-service platform highlights the agility required to thrive in Southeast Asia.

Recognising the inconsistent public transportation network prevalent in many SEA countries, Gojek filled this void effectively. Beyond transportation, it also catered to a substantial economic concern by providing over two million drivers with consistent income, in a region where specialised education opportunities are scant.

The company's IPO gesture, granting 600,000 drivers 4,000 shares each, showcases a deep-rooted commitment to establishing a balanced ecosystem benefiting all stakeholders: from the average driver to the local government benefiting from boosted employment.

2. Axie Infinity

Axie Infinity astutely tapped into a universal allure: the blend of gaming and monetary reward. Its game mechanics, echoing elements of CryptoKitties and Pokémon, appealed to a wide audience, but it was the financial opportunities it provided that truly resonated across the region.

In the Philippines, the game’s success was particularly evident. Amidst the challenges of the pandemic, Axie offered many the chance to earn approximately $800 monthly, a significant sum in local terms. This achievement underscores the importance of recognising common regional needs, like supplemental income sources, and adeptly adapting to the varying contexts within each SEA country.

3. Muji

Muji's success story in Southeast Asia is a testament to the power of understated branding and the significance of blending global strategies with local nuances. While its minimalist, 'no-brand' ethos has garnered global admiration, Muji's SEA strategy was replete with local cultural references.

Tapping into Singapore's café-hopping culture, Muji introduced its own minimalistic café, targeting younger shoppers. In Malaysia and Singapore, the stores showcased localised products, from instant Malaysian curry to traditional Chinese strainers.

Furthermore, Muji's adeptness at leveraging digital channels, like their #MUJIPENART campaign, showcases the potency of authentic, organic brand campaigns that resonate with the SEA audience.

Navigating the intricate Southeast Asian market is no small feat. At Baozun, we pride ourselves on being the torchbearers for brands looking to make a mark here. Our one-stop service approach covers the entire spectrum of the eCommerce value chain, from setting up online stores to handling logistics, ensuring that brands experience a seamless integration.

Our expertise lies in our omnichannel strategy, allowing brands to have a commanding presence across multiple online platforms and offline touchpoints. Coupled with our technological innovation, we provide brands with cutting-edge tools to ensure you and your brand stay ahead.

Contact us to explore the possibilities in Southeast Asia's market today.

Read Less...